ACADEMIC PERFORMANCE FOR

OHIO FOOTBALL PLAYOFF TEAMS - 2013

NOVEMBER 8, 2013

PRELIMINARY VERSION

PREPARED BY SCOTT GERBER

GERBER ANALYTICS, LLC

This document provides the academic results for the schools in the Ohio High School Athletic Association (OHSAA) football playoffs. To-date, school academic results have not been included as a factor in the Competitive Balance discussion. Academics should be a significant factor since the quality of education varies considerably by school and because it is one of the most important factors for most families when selecting a high school. This purpose of this document is to bring academics into the discussion.

This document is based on the Ohio Graduation Test (OGT) test results for Ohio's public (tax payer-funded) and private (customer-funded) schools for the March 2013 test. To insure an apples-to-apples comparison, only the tenth grader results are included.

What Was Included?

For those unfamiliar with the OGT tests, there are five parts -- Reading, Mathematics, Writing, Science, and Social Studies. There is also a summary page that shows the percentage of students who successfully passed all five parts with a “Proficient” rating. The data used in this report is from those five parts and the summary.

The Ohio Department of Education (ODE) Local Report Card data download capability was used to acquire most of the data for the public schools. The ODE provided electronic media as the source for the private school data, the charter schools, and the "percentage of students who passed all five parts" of the test for all schools.

Methodology Used

The table below includes each school's Performance Index Score (PIS); the percentage of students who passed all five portions of the Ohio Graduation Test (PASS 5%); statewide rankings for each school in the various subjects; and how the school is funded (via taxes or via its customers).

The statewide rankings range from 1 to approximately 991 in each subject and they are calculated using the Performance Index Score within each subject area. The rankings provide readers with not only academic performance information between schools, but they also identify strengths and weaknesses within schools. Note that the rankings for those schools that are in the top ten in Ohio in a subject are highlighted in light blue. Click here to go to the Appendix to view the PIS calculation. See below for more information about the rankings.

To view detailed performance on each school, click on the school name.

Note that the table is long -- it contains detailed data for all of the schools that reached the football playoffs (except for Manchester which was not reported). These schools are initially sorted according to their Division and Region, but they may also be sorted by school name, county, Performance Index Score, or Pass All Five Test %. Click on a link above to change the sort order. Click here to return to a Division / Region sort.

| HIGH SCHOOL / DISTRICT |

DIV REG |

PASS 5% |

STATEWIDE RANKINGS |

PAYER |

||||||

READING |

MATH |

WRITING |

SCIENCE |

SOCIAL STUDIES |

||||||

| St Charles Preparatory Columbus Diocese |

Franklin | II 5 |

116.4 |

100%

|

4

|

1

|

5

|

1

|

2

|

Cust |

| Madeira Madeira City |

Hamilton | V 18 |

115.1 |

97.2%

|

3

|

3

|

40

|

3

|

4

|

Tax |

| Summit Country Day OAIS - Summit Country Day |

Hamilton | VI 22 |

113.7 |

95.8%

|

46

|

40

|

1

|

18

|

8

|

Cust |

| Solon Solon City |

Cuyahoga | I 1 |

113.2 |

92.8%

|

19

|

56

|

29

|

16

|

34

|

Tax |

| Cedarville Cedar Cliff Local |

Greene | VII 26 |

113.1 |

97.8%

|

59

|

29

|

1

|

15

|

55

|

Tax |

| Aurora Aurora City |

Portage | III 7 |

113.1 |

95.9%

|

39

|

22

|

66

|

24

|

11

|

Tax |

| Hudson Hudson City |

Summit | I 1 |

112.8 |

96.0%

|

35

|

55

|

25

|

27

|

31

|

Tax |

| St Xavier Cincinnati Archdiocese |

Hamilton | I 2 |

112.7 |

97.0%

|

28

|

28

|

100

|

25

|

38

|

Cust |

| Cincinnati Hills Christian Academy OAIS - Cincinnati Hills Christian Academy |

Hamilton | V 18 |

112.6 |

94.5%

|

34

|

26

|

19

|

47

|

45

|

Cust |

| Chagrin Falls Chagrin Falls Exempted Village |

Cuyahoga | IV 11 |

112.3 |

96.7%

|

21

|

45

|

31

|

40

|

64

|

Tax |

| Wyoming Wyoming City |

Hamilton | IV 14 |

112.3 |

90.8%

|

44

|

38

|

61

|

58

|

28

|

Tax |

| Mariemont Mariemont City |

Hamilton | V 18 |

112.3 |

94.3%

|

50

|

76

|

16

|

43

|

36

|

Tax |

| Avon Lake Avon Lake City |

Lorain | II 4 |

112.1 |

95.0%

|

45

|

41

|

38

|

33

|

74

|

Tax |

| St Vincent-St Mary Cleveland Catholic Diocese |

Summit | III 7 |

111.5 |

94.9%

|

118

|

62

|

76

|

44

|

40

|

Cust |

| HIGH SCHOOL / DISTRICT |

DIV REG |

PIS |

PASS 5% |

STATEWIDE RANKINGS |

PAYER |

|||||

READING |

MATH |

WRITING |

SCIENCE |

SOCIAL STUDIES |

||||||

| St Ignatius Cleveland Catholic Diocese |

Cuyahoga | I 1 |

111.2 |

93.9%

|

41

|

77

|

110

|

80

|

56

|

Cust |

| Highland Highland Local |

Medina | II 4 |

111.1 |

91.9%

|

92

|

51

|

88

|

64

|

70

|

Tax |

| Arlington Arlington Local |

Hancock | VII 24 |

110.9 |

84.6%

|

206

|

18

|

274

|

75

|

5

|

Tax |

| Gilmour Academy OAIS - Gilmour Academy |

Cuyahoga | V 15 |

110.8 |

95.1%

|

86

|

58

|

44

|

115

|

94

|

Cust |

| Dublin Coffman Dublin City |

Franklin | I 2 |

110.8 |

91.5%

|

77

|

93

|

126

|

58

|

63

|

Tax |

| Beachwood Beachwood City |

Cuyahoga | V 15 |

110.6 |

88.4%

|

50

|

168

|

148

|

131

|

19

|

Tax |

| Bexley Bexley City |

Franklin | IV 13 |

110.6 |

88.7%

|

74

|

142

|

120

|

77

|

49

|

Tax |

| Cincinnati Country Day OAIS - Cincinnati Country Day |

Hamilton | VI 22 |

110.6 |

94.4%

|

67

|

92

|

66

|

52

|

169

|

Cust |

| Brecksville-Broadview Heights Brecksville-Broadview Heights City |

Cuyahoga | II 3 |

110.6 |

90.3%

|

93

|

94

|

99

|

73

|

72

|

Tax |

| Cuyahoga Heights Cuyahoga Heights Local |

Cuyahoga | VI 19 |

110.6 |

91.5%

|

56

|

36

|

103

|

179

|

80

|

Tax |

| Worthington Kilbourne Worthington City |

Franklin | II 5 |

110.6 |

89.0%

|

120

|

91

|

134

|

76

|

42

|

Tax |

| Archbishop Alter Cincinnati Archdiocese |

Montgomery | IV 14 |

110.5 |

91.9%

|

101

|

98

|

83

|

101

|

61

|

Cust |

| Lakeview Lakeview Local |

Trumbull | IV 11 |

110.5 |

92.8%

|

84

|

103

|

70

|

102

|

73

|

Tax |

| Newark Catholic Columbus Diocese |

Licking | VI 21 |

110.3 |

90.2%

|

83

|

228

|

104

|

121

|

21

|

Cust |

| Fairfield Christian Academy Fairfield Christian Academy El |

Fairfield | VII 25 |

110.3 |

92.9%

|

27

|

87

|

58

|

123

|

181

|

Cust |

| HIGH SCHOOL / DISTRICT |

DIV REG |

PIS |

PASS 5% |

STATEWIDE RANKINGS |

PAYER |

|||||

READING |

MATH |

WRITING |

SCIENCE |

SOCIAL STUDIES |

||||||

| Waynesville Wayne Local |

Warren | V 18 |

110.3 |

89.1%

|

163

|

74

|

141

|

78

|

58

|

Tax |

| John Hay Science & Medicine Cleveland Municipal SD |

Cuyahoga | IV 11 |

110.2 |

96.3%

|

113

|

60

|

79

|

159

|

77

|

Tax |

| Avon Avon Local |

Lorain | II 4 |

110.2 |

91.9%

|

82

|

112

|

125

|

114

|

66

|

Tax |

| Kirtland Kirtland Local |

Lake | VI 19 |

109.9 |

87.0%

|

152

|

105

|

82

|

84

|

117

|

Tax |

| Archbishop Moeller Cincinnati Archdiocese |

Hamilton | I 2 |

109.9 |

92.6%

|

102

|

122

|

112

|

126

|

76

|

Cust |

| South Range South Range Local |

Mahoning | VI 19 |

109.8 |

94.7%

|

111

|

95

|

152

|

86

|

109

|

Tax |

| Springboro Springboro Community City |

Warren | I 2 |

109.8 |

90.3%

|

109

|

118

|

182

|

63

|

102

|

Tax |

| West Geauga West Geauga Local |

Geauga | III 7 |

109.6 |

89.3%

|

170

|

82

|

131

|

148

|

89

|

Tax |

| New Albany New Albany-Plain Local |

Franklin | II 5 |

109.6 |

92.0%

|

121

|

99

|

93

|

142

|

125

|

Tax |

| Coldwater Coldwater Exempted Village |

Mercer | V 16 |

109.5 |

87.5%

|

208

|

42

|

222

|

103

|

87

|

Tax |

| Norwalk St. Paul Toledo Diocese |

Huron | VII 23 |

109.5 |

93.8%

|

114

|

235

|

62

|

134

|

98

|

Cust |

| Bishop Ready Columbus Diocese |

Franklin | VI 21 |

109.5 |

89.3%

|

87

|

210

|

140

|

177

|

47

|

Cust |

| Archbishop McNicholas Cincinnati Archdiocese |

Hamilton | IV 14 |

109.3 |

93.0%

|

88

|

162

|

50

|

175

|

167

|

Cust |

| Perrysburg Perrysburg Exempted Village |

Wood | II 4 |

109.2 |

90.1%

|

130

|

201

|

118

|

98

|

119

|

Tax |

| St Edward Cleveland Catholic Diocese |

Cuyahoga | I 1 |

109.1 |

86.3%

|

132

|

151

|

81

|

109

|

203

|

Cust |

| HIGH SCHOOL / DISTRICT |

DIV REG |

PIS |

PASS 5% |

STATEWIDE RANKINGS |

PAYER |

|||||

READING |

MATH |

WRITING |

SCIENCE |

SOCIAL STUDIES |

||||||

| McDonald McDonald Local |

Trumbull | VI 19 |

108.9 |

87.5%

|

189

|

49

|

156

|

156

|

171

|

Tax |

| Kings Kings Local |

Warren | II 6 |

108.8 |

84.8%

|

144

|

85

|

155

|

208

|

141

|

Tax |

| Wheelersburg Wheelersburg Local |

Scioto | V 17 |

108.8 |

85.2%

|

178

|

287

|

14

|

214

|

92

|

Tax |

| Centerville Centerville City |

Montgomery | I 2 |

108.8 |

86.5%

|

148

|

150

|

137

|

147

|

148

|

Tax |

| Hicksville Hicksville Exempted Village |

Defiance | VII 24 |

108.7 |

85.9%

|

148

|

156

|

45

|

213

|

168

|

Tax |

| Marion Local Marion Local |

Mercer | VII 26 |

108.7 |

84.8%

|

216

|

43

|

18

|

179

|

355

|

Tax |

| Lima Central Catholic Toledo Diocese |

Allen | VI 20 |

108.4 |

93.1%

|

204

|

257

|

74

|

149

|

139

|

Cust |

| Steubenville Catholic Central Steubenville Diocese |

Jefferson | VII 25 |

108.4 |

87.3%

|

81

|

326

|

73

|

48

|

368

|

Cust |

| Bishop Hartley Columbus Diocese |

Franklin | V 17 |

108.3 |

88.1%

|

108

|

236

|

116

|

206

|

159

|

Cust |

| Tippecanoe Tipp City Exempted Village |

Miami | III 10 |

108.2 |

87.9%

|

119

|

242

|

198

|

110

|

210

|

Tax |

| Lehman Catholic Cincinnati Archdiocese |

Shelby | VII 26 |

108.2 |

89.1%

|

199

|

159

|

197

|

66

|

292

|

Cust |

| Pickerington North Pickerington Local |

Fairfield | I 2 |

108.2 |

87.2%

|

159

|

264

|

187

|

170

|

112

|

Tax |

| Toledo St Francis DeSales Toledo Diocese |

Lucas | II 4 |

108.2 |

88.5%

|

184

|

144

|

266

|

138

|

154

|

Cust |

| Wadsworth Wadsworth City |

Medina | I 1 |

108.1 |

87.3%

|

215

|

123

|

171

|

183

|

174

|

Tax |

| Miami East Miami East Local |

Miami | VI 22 |

108.1 |

86.5%

|

287

|

73

|

154

|

164

|

244

|

Tax |

| HIGH SCHOOL / DISTRICT |

DIV REG |

PIS |

PASS 5% |

STATEWIDE RANKINGS |

PAYER |

|||||

READING |

MATH |

WRITING |

SCIENCE |

SOCIAL STUDIES |

||||||

| Kenston Kenston Local |

Geauga | III 7 |

108.1 |

84.9%

|

174

|

181

|

149

|

160

|

205

|

Tax |

| Loveland Loveland City |

Hamilton | II 6 |

108.1 |

86.6%

|

140

|

165

|

254

|

153

|

185

|

Tax |

| Butler Vandalia-Butler City |

Montgomery | II 6 |

107.9 |

86.7%

|

187

|

308

|

158

|

143

|

148

|

Tax |

| Lakota West Lakota Local |

Butler | I 2 |

107.9 |

85.7%

|

151

|

145

|

205

|

191

|

210

|

Tax |

| Fort Loramie Fort Loramie Local |

Shelby | VII 26 |

107.7 |

83.3%

|

242

|

60

|

268

|

151

|

303

|

Tax |

| Bloom-Carroll Bloom-Carroll Local |

Fairfield | IV 13 |

107.7 |

86.3%

|

222

|

166

|

334

|

183

|

118

|

Tax |

| Brunswick Brunswick City |

Medina | I 1 |

107.6 |

85.5%

|

242

|

199

|

196

|

202

|

158

|

Tax |

| Hilliard Davidson Hilliard City |

Franklin | I 2 |

107.5 |

85.1%

|

267

|

161

|

268

|

172

|

175

|

Tax |

| Eastwood Eastwood Local |

Wood | V 16 |

107.4 |

87.9%

|

182

|

214

|

185

|

157

|

294

|

Tax |

| Berlin Western Reserve Western Reserve Local |

Mahoning | VII 23 |

107.3 |

79.0%

|

301

|

67

|

142

|

194

|

400

|

Tax |

| Wauseon Wauseon Exempted Village |

Fulton | IV 12 |

107.3 |

81.3%

|

167

|

176

|

250

|

237

|

207

|

Tax |

| Elder Cincinnati Archdiocese |

Hamilton | I 2 |

107.2 |

87.7%

|

169

|

205

|

208

|

215

|

267

|

Cust |

| Portsmouth Notre Dame Columbus Diocese |

Scioto | VII 26 |

107.1 |

82.6%

|

117

|

233

|

333

|

282

|

157

|

Tax |

| Fairland Fairland Local |

Lawrence | V 17 |

107.1 |

84.3%

|

234

|

267

|

263

|

197

|

161

|

Tax |

| Valley View Valley View Local |

Montgomery | IV 14 |

107.1 |

84.6%

|

248

|

222

|

177

|

182

|

273

|

Tax |

| HIGH SCHOOL / DISTRICT |

DIV REG |

PIS |

PASS 5% |

STATEWIDE RANKINGS |

PAYER |

|||||

READING |

MATH |

WRITING |

SCIENCE |

SOCIAL STUDIES |

||||||

| Poland Seminary Poland Local |

Mahoning | III 7 |

107.0 |

85.6%

|

185

|

173

|

213

|

207

|

317

|

Tax |

| Liberty Union Liberty Union-Thurston Local |

Fairfield | V 17 |

106.8 |

89.3%

|

211

|

283

|

214

|

226

|

206

|

Tax |

| Tinora Northeastern Local |

Defiance | VI 20 |

106.8 |

87.5%

|

406

|

143

|

324

|

124

|

251

|

Tax |

| Mentor Mentor Exempted Village |

Lake | I 1 |

106.8 |

83.8%

|

205

|

221

|

306

|

203

|

233

|

Tax |

| Covington Covington Exempted Village |

Miami | VII 26 |

106.4 |

84.5%

|

280

|

281

|

172

|

269

|

259

|

Tax |

| Stephen T Badin Cincinnati Archdiocese |

Butler | V 18 |

106.4 |

83.1%

|

349

|

270

|

209

|

292

|

173

|

Cust |

| Marysville Marysville Exempted Village |

Union | I 1 |

106.3 |

80.4%

|

319

|

191

|

398

|

231

|

195

|

Tax |

| Liberty-Benton Liberty-Benton Local |

Hancock | V 16 |

106.2 |

84.0%

|

441

|

239

|

210

|

270

|

213

|

Tax |

| Nordonia Nordonia Hills City |

Summit | II 4 |

106.1 |

78.9%

|

237

|

225

|

241

|

254

|

362

|

Tax |

| Hilliard Darby Hilliard City |

Franklin | I 2 |

106.1 |

85.2%

|

292

|

245

|

343

|

268

|

222

|

Tax |

| Convoy Crestview Crestview Local |

Van Wert | VI 20 |

106.1 |

76.8%

|

244

|

392

|

346

|

294

|

121

|

Tax |

| Genoa Area Genoa Area Local |

Ottawa | IV 12 |

106.0 |

86.3%

|

383

|

293

|

322

|

185

|

228

|

Tax |

| Black River Black River Local |

Medina | V 15 |

105.9 |

78.0%

|

312

|

216

|

147

|

234

|

460

|

Tax |

| West Liberty-Salem West Liberty-Salem Local |

Champaign | VI 22 |

105.9 |

79.3%

|

355

|

286

|

438

|

216

|

172

|

Tax |

| Chippewa Chippewa Local |

Wayne | V 16 |

105.8 |

82.1%

|

251

|

313

|

232

|

280

|

312

|

Tax |

| HIGH SCHOOL / DISTRICT |

DIV REG |

PIS |

PASS 5% |

STATEWIDE RANKINGS |

PAYER |

|||||

READING |

MATH |

WRITING |

SCIENCE |

SOCIAL STUDIES |

||||||

| Stow-Munroe Falls Stow-Munroe Falls City |

Summit | I 1 |

105.8 |

80.4%

|

260

|

278

|

354

|

245

|

297

|

Tax |

| Medina Buckeye Buckeye Local |

Medina | III 8 |

105.8 |

81.4%

|

343

|

208

|

481

|

257

|

195

|

Tax |

| Delphos St John's Toledo Diocese |

Allen | VII 24 |

105.8 |

83.9%

|

328

|

490

|

224

|

298

|

128

|

Cust |

| Lowellville Lowellville Local |

Mahoning | VII 23 |

105.7 |

85.7%

|

278

|

412

|

212

|

299

|

236

|

Tax |

| Marlington Marlington Local |

Stark | III 7 |

105.7 |

83.1%

|

295

|

329

|

369

|

262

|

200

|

Tax |

| Dublin Scioto Dublin City |

Franklin | II 5 |

105.5 |

78.0%

|

256

|

305

|

462

|

242

|

268

|

Tax |

| West Salem Northwestern Northwestern Local |

Wayne | V 16 |

105.5 |

79.8%

|

253

|

414

|

395

|

276

|

186

|

Tax |

| Youngstown Ursuline Youngstown Diocese |

Mahoning | V 15 |

105.5 |

76.9%

|

259

|

443

|

223

|

468

|

127

|

Cust |

| Huron Huron City |

Erie | V 16 |

105.5 |

78.1%

|

213

|

363

|

511

|

241

|

194

|

Tax |

| Westerville Central Westerville City |

Franklin | I 1 |

105.4 |

81.2%

|

313

|

335

|

414

|

281

|

209

|

Tax |

| Jefferson Delphos City |

Allen | VI 20 |

105.4 |

82.2%

|

400

|

310

|

373

|

352

|

140

|

Tax |

| Colerain Northwest Local |

Hamilton | I 2 |

105.3 |

80.3%

|

337

|

357

|

282

|

330

|

228

|

Tax |

| Dover Dover City |

Tuscarawas | III 9 |

105.1 |

84.7%

|

464

|

255

|

337

|

196

|

402

|

Tax |

| Licking Valley Licking Valley Local |

Licking | IV 13 |

105.1 |

81.6%

|

414

|

302

|

236

|

296

|

342

|

Tax |

| St Thomas Aquinas Youngstown Diocese |

Stark | VI 19 |

105.0 |

77.6%

|

404

|

394

|

122

|

387

|

316

|

Cust |

| HIGH SCHOOL / DISTRICT |

DIV REG |

PIS |

PASS 5% |

STATEWIDE RANKINGS |

PAYER |

|||||

READING |

MATH |

WRITING |

SCIENCE |

SOCIAL STUDIES |

||||||

| Woodridge Woodridge Local |

Summit | IV 11 |

104.9 |

74.2%

|

219

|

472

|

215

|

526

|

213

|

Tax |

| Triad Triad Local |

Champaign | VII 26 |

104.9 |

71.8%

|

362

|

363

|

458

|

337

|

170

|

Tax |

| Leipsic Leipsic Local |

Putnam | VII 24 |

104.8 |

84.4%

|

592

|

241

|

183

|

362

|

327

|

Tax |

| Louisville Louisville City |

Stark | III 7 |

104.6 |

79.9%

|

347

|

293

|

298

|

322

|

438

|

Tax |

| Licking Heights Licking Heights Local |

Licking | II 5 |

104.6 |

77.8%

|

475

|

332

|

429

|

430

|

153

|

Tax |

| Calvert Toledo Diocese |

Seneca | VII 24 |

104.3 |

82.9%

|

424

|

229

|

287

|

453

|

413

|

Tax |

| Columbiana Crestview Crestview Local |

Columbiana | V 15 |

104.1 |

69.0%

|

272

|

336

|

474

|

330

|

436

|

Tax |

| Chaminade-Julienne Cincinnati Archdiocese |

Montgomery | V 18 |

104.0 |

76.4%

|

371

|

422

|

277

|

412

|

365

|

Cust |

| Columbia Columbia Local |

Lorain | V 16 |

104.0 |

80.2%

|

386

|

289

|

671

|

220

|

356

|

Tax |

| Wapakoneta Wapakoneta City |

Auglaize | III 10 |

104.0 |

77.4%

|

422

|

365

|

396

|

359

|

332

|

Tax |

| Millbury Lake Lake Local |

Wood | IV 12 |

104.0 |

84.1%

|

360

|

348

|

388

|

381

|

377

|

Tax |

| John Glenn East Muskingum Local |

Muskingum | IV 13 |

103.9 |

75.3%

|

311

|

431

|

252

|

354

|

476

|

Tax |

| Edon Edon-Northwest Local |

Williams | VII 24 |

103.9 |

73.8%

|

258

|

396

|

353

|

287

|

561

|

Tax |

| Willoughby South Willoughby-Eastlake City |

Lake | II 3 |

103.7 |

78.8%

|

445

|

341

|

387

|

345

|

440

|

Tax |

| Williamsburg Williamsburg Local |

Clermont | VI 22 |

103.7 |

75.0%

|

340

|

474

|

233

|

510

|

375

|

Tax |

| HIGH SCHOOL / DISTRICT |

DIV REG |

PIS |

PASS 5% |

STATEWIDE RANKINGS |

PAYER |

|||||

READING |

MATH |

WRITING |

SCIENCE |

SOCIAL STUDIES |

||||||

| Riverside Riverside Local |

Lake | II 3 |

103.6 |

76.3%

|

330

|

435

|

638

|

341

|

280

|

Tax |

| Maysville Maysville Local |

Muskingum | IV 13 |

103.3 |

75.0%

|

420

|

423

|

319

|

564

|

329

|

Tax |

| Athens Athens City |

Athens | III 9 |

103.2 |

78.4%

|

415

|

547

|

360

|

419

|

359

|

Tax |

| Benedictine Cleveland Catholic Diocese |

Cuyahoga | IV 11 |

103.1 |

75.7%

|

322

|

446

|

336

|

597

|

366

|

Tax |

| Shaker Heights Shaker Heights City |

Cuyahoga | I 1 |

103.1 |

75.3%

|

333

|

607

|

389

|

396

|

369

|

Tax |

| Pickerington Central Pickerington Local |

Fairfield | I 2 |

103.1 |

73.9%

|

380

|

377

|

566

|

446

|

361

|

Tax |

| Colonel Crawford Colonel Crawford Local |

Crawford | VI 20 |

103.1 |

72.6%

|

503

|

385

|

552

|

310

|

393

|

Tax |

| Springfield Shawnee Clark-Shawnee Local |

Clark | III 10 |

103.0 |

75.7%

|

269

|

393

|

520

|

525

|

421

|

Tax |

| Northmont Northmont City |

Montgomery | I 2 |

103.0 |

76.6%

|

399

|

436

|

578

|

355

|

408

|

Tax |

| Napoleon Napoleon Area City |

Henry | III 8 |

102.9 |

79.1%

|

535

|

562

|

425

|

389

|

303

|

Tax |

| Toledo Central Catholic Toledo Diocese |

Lucas | III 8 |

102.9 |

75.6%

|

391

|

462

|

216

|

499

|

559

|

Cust |

| Perkins Perkins Local |

Erie | III 8 |

102.8 |

76.3%

|

455

|

645

|

230

|

454

|

364

|

Tax |

| Clinton Massie Clinton-Massie Local |

Clinton | IV 14 |

102.7 |

71.9%

|

235

|

533

|

518

|

448

|

469

|

Tax |

| Mechanicsburg Mechanicsburg Exempted Village |

Champaign | VI 22 |

102.5 |

70.1%

|

369

|

600

|

708

|

350

|

270

|

Tax |

| Philo Franklin Local |

Muskingum | IV 13 |

102.5 |

72.9%

|

529

|

406

|

733

|

407

|

237

|

Tax |

| HIGH SCHOOL / DISTRICT |

DIV REG |

PIS |

PASS 5% |

STATEWIDE RANKINGS |

PAYER |

|||||

READING |

MATH |

WRITING |

SCIENCE |

SOCIAL STUDIES |

||||||

| Bryan Bryan City |

Williams | IV 12 |

102.5 |

75.8%

|

440

|

527

|

401

|

520

|

414

|

Tax |

| Franklin Franklin City |

Warren | III 10 |

102.5 |

74.1%

|

591

|

479

|

630

|

422

|

264

|

Tax |

| Caldwell Caldwell Exempted Village |

Noble | VII 25 |

102.4 |

78.0%

|

429

|

557

|

419

|

390

|

505

|

Tax |

| Struthers Struthers City |

Mahoning | IV 11 |

102.4 |

77.9%

|

428

|

604

|

321

|

551

|

367

|

Tax |

| Hubbard Hubbard Exempted Village |

Trumbull | III 7 |

102.3 |

73.0%

|

513

|

515

|

491

|

492

|

372

|

Tax |

| Cardinal Mooney Youngstown Diocese |

Mahoning | IV 11 |

102.2 |

69.9%

|

353

|

602

|

170

|

555

|

588

|

Cust |

| Triway Triway Local |

Wayne | IV 12 |

102.2 |

74.8%

|

557

|

470

|

581

|

400

|

401

|

Tax |

| Columbian Tiffin City |

Seneca | III 8 |

102.2 |

74.9%

|

425

|

389

|

496

|

414

|

607

|

Tax |

| Fairfield Fairfield City |

Butler | I 2 |

102.0 |

72.6%

|

420

|

410

|

492

|

562

|

513

|

Tax |

| Trinity Cleveland Catholic Diocese |

Cuyahoga | VII 23 |

102.0 |

74.6%

|

220

|

750

|

323

|

392

|

475

|

Tax |

| St Clairsville St Clairsville-Richland City |

Belmont | V 17 |

102.0 |

79.4%

|

436

|

562

|

293

|

539

|

531

|

Tax |

| Fremont St Joseph Central Catholic Toledo Diocese |

Sandusky | VII 24 |

101.9 |

73.5%

|

434

|

774

|

194

|

474

|

319

|

Cust |

| Kenton Ridge Northeastern Local |

Clark | III 10 |

101.9 |

76.5%

|

458

|

508

|

394

|

476

|

579

|

Tax |

| Madison Madison Local |

Butler | II 3 |

101.9 |

78.1%

|

422

|

520

|

559

|

535

|

429

|

Tax |

| Miamisburg Miamisburg City |

Montgomery | I 2 |

101.9 |

72.9%

|

465

|

596

|

427

|

535

|

431

|

Tax |

| HIGH SCHOOL / DISTRICT |

DIV REG |

PIS |

PASS 5% |

STATEWIDE RANKINGS |

PAYER |

|||||

READING |

MATH |

WRITING |

SCIENCE |

SOCIAL STUDIES |

||||||

| Tri-County North Tri-County North Local |

Preble | VI 22 |

101.9 |

82.7%

|

689

|

343

|

539

|

493

|

406

|

Tax |

| Mogadore Mogadore Local |

Summit | VI 19 |

101.9 |

73.3%

|

335

|

343

|

663

|

403

|

631

|

Tax |

| Danville Danville Local |

Knox | VII 23 |

101.5 |

76.5%

|

540

|

574

|

508

|

357

|

583

|

Tax |

| Ada Ada Exempted Village |

Hardin | VI 20 |

101.5 |

79.7%

|

651

|

473

|

540

|

542

|

392

|

Tax |

| Indian Valley Indian Valley Local |

Tuscarawas | IV 13 |

101.4 |

74.3%

|

593

|

585

|

468

|

576

|

412

|

Tax |

| Wayne Trace Wayne Trace Local |

Paulding | VI 20 |

101.3 |

68.8%

|

653

|

524

|

284

|

405

|

669

|

Tax |

| Brookfield Brookfield Local |

Trumbull | VI 19 |

101.3 |

64.9%

|

712

|

657

|

345

|

469

|

373

|

Tax |

| New Philadelphia New Philadelphia City |

Tuscarawas | III 9 |

101.3 |

69.7%

|

506

|

522

|

587

|

507

|

491

|

Tax |

| Chalker Southington Local |

Trumbull | VII 23 |

101.2 |

69.8%

|

699

|

356

|

614

|

212

|

706

|

Tax |

| Western Brown Western Brown Local |

Brown | III 10 |

101.1 |

72.5%

|

497

|

447

|

505

|

639

|

533

|

Tax |

| Tri-Valley Tri-Valley Local |

Muskingum | III 9 |

101.1 |

66.5%

|

607

|

555

|

636

|

495

|

433

|

Tax |

| Wayne Huber Heights City |

Montgomery | I 2 |

101.1 |

71.8%

|

449

|

609

|

510

|

579

|

478

|

Tax |

| National Trail National Trail Local |

Preble | VI 22 |

101.1 |

70.2%

|

443

|

545

|

454

|

588

|

586

|

Tax |

| Kent Roosevelt Kent City |

Portage | II 3 |

100.9 |

71.2%

|

453

|

724

|

373

|

494

|

519

|

Tax |

| West Jefferson Jefferson Local |

Madison | V 18 |

100.8 |

74.7%

|

686

|

477

|

362

|

639

|

525

|

Tax |

| HIGH SCHOOL / DISTRICT |

DIV REG |

PIS |

PASS 5% |

STATEWIDE RANKINGS |

PAYER |

|||||

READING |

MATH |

WRITING |

SCIENCE |

SOCIAL STUDIES |

||||||

| Austintown-Fitch Austintown Local |

Mahoning | I 1 |

100.7 |

70.9%

|

514

|

584

|

501

|

572

|

590

|

Tax |

| Fort Frye Fort Frye Local |

Washington | VI 21 |

100.7 |

76.7%

|

594

|

566

|

735

|

430

|

457

|

Tax |

| Miami Trace Miami Trace Local |

Fayette | IV 14 |

100.6 |

69.3%

|

573

|

452

|

452

|

543

|

691

|

Tax |

| Harrison Southwest Local |

Hamilton | II 6 |

100.6 |

73.0%

|

576

|

564

|

551

|

590

|

513

|

Tax |

| North Union North Union Local |

Union | V 18 |

100.5 |

72.0%

|

640

|

380

|

506

|

485

|

712

|

Tax |

| Cincinnati Northwest Northwest Local |

Hamilton | II 6 |

100.5 |

69.2%

|

490

|

564

|

566

|

596

|

572

|

Tax |

| Galion Galion City |

Crawford | IV 12 |

100.1 |

61.8%

|

409

|

468

|

686

|

605

|

672

|

Tax |

| Norwalk Norwalk City |

Huron | III 8 |

100.1 |

70.9%

|

688

|

464

|

672

|

565

|

554

|

Tax |

| Logan Elm Logan Elm Local |

Pickaway | III 9 |

100.1 |

67.7%

|

584

|

535

|

719

|

533

|

537

|

Tax |

| Clyde Clyde-Green Springs Exempted Village |

Sandusky | III 8 |

99.7 |

67.5%

|

705

|

553

|

745

|

566

|

447

|

Tax |

| Massillon Washington Massillon City |

Stark | II 4 |

99.5 |

67.5%

|

608

|

603

|

665

|

670

|

506

|

Tax |

| Westfall Westfall Local |

Pickaway | V 17 |

99.5 |

70.3%

|

495

|

650

|

619

|

662

|

564

|

Tax |

| Martins Ferry Martins Ferry City |

Belmont | V 17 |

99.5 |

71.0%

|

724

|

572

|

753

|

581

|

443

|

Tax |

| Whitmer Washington Local |

Lucas | I 1 |

99.5 |

68.9%

|

638

|

613

|

618

|

657

|

538

|

Tax |

| Youngstown Liberty Liberty Local |

Trumbull | V 15 |

99.3 |

69.2%

|

596

|

646

|

426

|

530

|

746

|

Tax |

| HIGH SCHOOL / DISTRICT |

DIV REG |

PIS |

PASS 5% |

STATEWIDE RANKINGS |

PAYER |

|||||

READING |

MATH |

WRITING |

SCIENCE |

SOCIAL STUDIES |

||||||

| Defiance Defiance City |

Defiance | III 8 |

99.3 |

68.7%

|

559

|

618

|

517

|

523

|

755

|

Tax |

| Loudonville Loudonville-Perrysville Exempted Village |

Ashland | V 16 |

99.0 |

66.3%

|

488

|

577

|

767

|

585

|

663

|

Tax |

| River Valley River Valley Local |

Marion | IV 12 |

98.9 |

72.7%

|

606

|

569

|

646

|

630

|

700

|

Tax |

| Centerburg Centerburg Local |

Knox | VI 21 |

98.8 |

67.1%

|

276

|

510

|

192

|

424

|

714

|

Tax |

| Circleville Circleville City |

Pickaway | IV 14 |

98.3 |

62.2%

|

615

|

560

|

682

|

629

|

746

|

Tax |

| Chillicothe Chillicothe City |

Ross | III 9 |

98.2 |

67.4%

|

526

|

688

|

563

|

645

|

744

|

Tax |

| McComb McComb Local |

Hancock | VII 24 |

98.2 |

66.7%

|

723

|

340

|

848

|

567

|

647

|

Tax |

| Kenton Kenton City |

Hardin | IV 12 |

98.2 |

58.3%

|

710

|

706

|

722

|

595

|

568

|

Tax |

| Mapleton Mapleton Local |

Ashland | VII 23 |

98.0 |

73.4%

|

692

|

740

|

526

|

655

|

634

|

Tax |

| Oak Hill Oak Hill Union Local |

Jackson | VI 21 |

98.0 |

66.3%

|

656

|

696

|

586

|

609

|

724

|

Tax |

| Fairless Fairless Local |

Stark | V 15 |

97.5 |

66.4%

|

752

|

528

|

736

|

699

|

688

|

Tax |

| Shadyside Shadyside Local |

Belmont | VII 25 |

97.5 |

60.0%

|

731

|

663

|

656

|

652

|

723

|

Tax |

| Wellsville Wellsville Local |

Columbiana | VII 23 |

97.4 |

64.3%

|

654

|

773

|

616

|

749

|

435

|

Tax |

| Zane Trace Zane Trace Local |

Ross | V 17 |

97.4 |

66.4%

|

738

|

721

|

554

|

557

|

758

|

Tax |

| Villa Angela-St Joseph Cleveland Catholic Diocese |

Cuyahoga | VI 19 |

97.3 |

67.1%

|

598

|

747

|

295

|

711

|

777

|

Cust |

| HIGH SCHOOL / DISTRICT |

DIV REG |

PIS |

PASS 5% |

STATEWIDE RANKINGS |

PAYER |

|||||

READING |

MATH |

WRITING |

SCIENCE |

SOCIAL STUDIES |

||||||

| Urbana Urbana City |

Champaign | IV 14 |

97.3 |

68.6%

|

727

|

659

|

648

|

715

|

689

|

Tax |

| Valley Valley Local |

Scioto | VI 21 |

96.9 |

63.0%

|

764

|

521

|

667

|

752

|

718

|

Tax |

| Elyria Elyria City Schools |

Lorain | I 1 |

96.8 |

63.7%

|

703

|

680

|

775

|

708

|

656

|

Tax |

| Southern Southern Local |

Meigs | VII 25 |

96.8 |

61.1%

|

746

|

662

|

574

|

702

|

765

|

Tax |

| Ellet Akron City |

Summit | II 4 |

96.8 |

61.5%

|

649

|

718

|

713

|

704

|

711

|

Tax |

| Winton Woods Winton Woods City |

Hamilton | II 6 |

96.0 |

64.0%

|

704

|

755

|

663

|

754

|

676

|

Tax |

| Northwood Northwood Local |

Wood | VI 20 |

95.3 |

55.4%

|

736

|

716

|

790

|

743

|

721

|

Tax |

| Steubenville Steubenville City |

Jefferson | IV 13 |

95.1 |

55.3%

|

768

|

711

|

793

|

730

|

730

|

Tax |

| Malvern Brown Local |

Carroll | VII 25 |

94.7 |

53.7%

|

802

|

736

|

808

|

741

|

675

|

Tax |

| Brush South Euclid-Lyndhurst City |

Cuyahoga | II 3 |

94.3 |

59.1%

|

701

|

785

|

658

|

786

|

734

|

Tax |

| Beallsville Switzerland of Ohio Local |

Monroe | VII 25 |

94.3 |

56.7%

|

745

|

803

|

678

|

746

|

753

|

Tax |

| Bedford Bedford City |

Cuyahoga | II 3 |

94.0 |

57.2%

|

771

|

737

|

741

|

787

|

738

|

Tax |

| Monroe Central Switzerland of Ohio Local |

Monroe | VI 21 |

93.7 |

58.9%

|

725

|

802

|

688

|

750

|

793

|

Tax |

| Cleveland Heights Cleveland Heights-University Heights City |

Cuyahoga | I 1 |

93.5 |

53.8%

|

670

|

792

|

731

|

795

|

750

|

Tax |

| Trimble Trimble Local |

Athens | VII 25 |

93.4 |

57.6%

|

791

|

697

|

771

|

765

|

827

|

Tax |

| HIGH SCHOOL / DISTRICT |

DIV REG |

PIS |

PASS 5% |

STATEWIDE RANKINGS |

PAYER |

|||||

READING |

MATH |

WRITING |

SCIENCE |

SOCIAL STUDIES |

||||||

| Bellaire Bellaire City |

Belmont | VI 21 |

92.7 |

49.4%

|

811

|

726

|

811

|

759

|

822

|

Tax |

| Zanesville Zanesville City |

Muskingum | II 5 |

92.4 |

45.7%

|

803

|

729

|

804

|

785

|

808

|

Tax |

| Cincinnati Withrow University HS Cincinnati City |

Hamilton | II 6 |

91.6 |

45.9%

|

815

|

782

|

639

|

844

|

783

|

Tax |

| Mansfield Senior Mansfield City |

Richland | II 5 |

90.8 |

53.8%

|

817

|

809

|

784

|

782

|

826

|

Tax |

| Northland Columbus City |

Franklin | II 5 |

90.2 |

47.4%

|

812

|

813

|

758

|

814

|

822

|

Tax |

| Canton McKinley Canton City |

Stark | I 1 |

90.1 |

49.9%

|

832

|

808

|

786

|

813

|

810

|

Tax |

| Trotwood-Madison Trotwood-Madison City |

Montgomery | III 10 |

89.3 |

46.6%

|

825

|

834

|

813

|

840

|

769

|

Tax |

| Mount Healthy Mt Healthy City |

Hamilton | II 6 |

88.7 |

44.9%

|

851

|

804

|

876

|

838

|

788

|

Tax |

| Cleveland Central Catholic Cleveland Catholic Diocese |

Cuyahoga | IV 11 |

87.5 |

40.8%

|

813

|

893

|

724

|

845

|

828

|

Cust |

| Paint Valley Paint Valley Local |

Ross | VII 26 |

85.7 |

32.3%

|

846

|

837

|

895

|

804

|

878

|

Tax |

| Marion-Franklin Columbus City |

Franklin | III 9 |

83.2 |

33.7%

|

883

|

870

|

866

|

877

|

859

|

Tax |

| Thurgood Marshall Dayton City |

Montgomery | III 10 |

81.0 |

33.6%

|

915

|

916

|

887

|

887

|

843

|

Tax |

| Brookhaven Columbus City |

Franklin | III 9 |

78.3 |

24.8%

|

899

|

932

|

912

|

902

|

882

|

Tax |

| Glenville Cleveland Municipal SD |

Cuyahoga | II 3 |

65.3 |

15.7%

|

974

|

982

|

947

|

975

|

966

|

Tax |

| Manchester Manchester Local |

Summit | V 15 |

NR |

77.1%

|

NR

|

NR

|

NR

|

NR

|

NR

|

Tax |

Comparative Analysis

While the performance numbers and trend charts are beneficial, what sets this web site apart from others is the comparative analysis that this site permits with other schools and within schools.

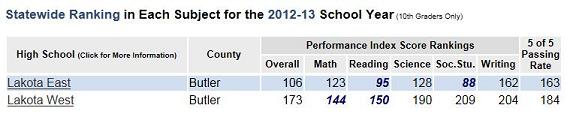

An example of a side-by-side comparison is here with Lakota East and Lakota West. As with most schools within the same school system, the results are similar.

Looking at a comparison within a school, Lakota East excels in Reading and Social Studies. Lakota West is stronger in Mathematics and Reading. Lakota East is also substantially better in Reading and Social Studies than Lakota West.

Looking at a comparison within a school, Lakota East excels in Reading and Social Studies. Lakota West is stronger in Mathematics and Reading. Lakota East is also substantially better in Reading and Social Studies than Lakota West.

One of the goals for this web site is to encourage communities to become better informed and to ask questions. I believe these tools encourage this.

Ranking List for All Schools

For the complete ranking list of all schools in Ohio, click here.

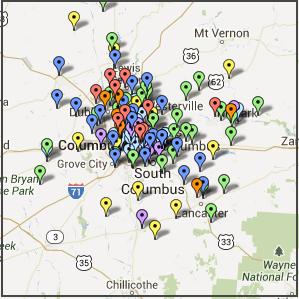

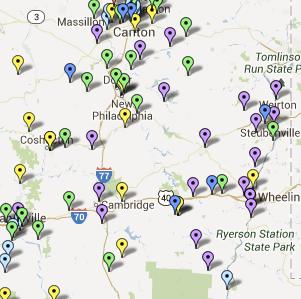

Map of Ohio High Schools

To easily visualize the football playoff schools and all Ohio schools, click the map image below for the Northwest, Northeast, Central, Southwest, and Southeast / East schools. Schools are color-coded by academic performance using the Performance Index Score.

|

|

|

|

||

|

|

|

| Click on an image to see a Google map of that area. | ||

Hover over the marker to see the school name. Click on the marker to see the school's Performance Index Score.

The satellite view is also available via the controls on the upper right.

Continuous Improvement

A major benefit of the Internet is that it is relatively easy to improve existing products and services. This report will likely be enhanced over time. The date of the report will be changed to reflect any changes. [Note: two the maps to the right need adjustment and that will occur later today.]

Corrections / Attribution

Does this document include any mistakes? Hopefully not, the data was carefully entered and the numbers were double checked, but it is possible. Please send a Feedback message with any significant discrepancies. The revised document will be updated and placed online.

While it would certainly be great to profit from this effort, please record the last seven years of this education analysis as a pro-bono or volunteer effort. I do this type of analysis because I enjoy doing it. I am also hopeful that it will benefit an extremely large number of Ohioans.

You may forward this report to anyone you wish but please give proper attribution if you use any of this material. To assist with tracking, please provide others with this link:

http://gerberanalytics.com/ogt/ogt_football_2013.php

I have a substantial "one-of-a-kind" database, and I am open to new analysis projects. If you have an education-related analysis project in mind that you think would benefit all Ohio schools, please contact me.

Please let me know if you have any questions or comments.

Scott Gerber

Gerber Analytics, LLC

GerberAnalytics.com

Click to submit a Feedback for any questions and/or to have your email address included so that you may be alerted to additional analysis.

Calculation of Performance Index Score (Adjusted)

Note that the Performance Index Score (Adjusted) is different from what you may have seen on the Ohio Department of Education’s Report Card. The calculation in this document is only for the 10th grade students. It was calculated as follows:

Ada High School

Subject |

Below Basic | Basic | Proficient | Accelerated | Advanced |

|

| Mathematics | 9.4% | 9.4% | 24.5% | 20.8% | 35.8% | |

| Reading | 3.8% | 5.7% | 43.4% | 35.8% | 11.3% | |

| Science | 3.8% | 18.9% | 26.4% | 22.6% | 28.3% | |

| Social Studies | 15.1% | 9.4% | 24.5% | 22.6% | 28.3% | |

| Writing | 5.7% | 5.7% | 39.6% | 47.2% | 1.9% | |

| Total of Above | 37.7% | 49.1% | 158.5% | 149.1% | 105.7% | |

| Average of 5 | 7.5% | 9.8% | 31.7% | 29.8% | 21.1% | |

| Factor | 0.3 | 0.6 | 1 | 1.1 | 1.2 | |

| Summation | ||||||

| Average * Factor | 2.3 | 5.9 | 31.7 | 32.8 | 25.4 | 98 |

The new "Advanced Plus" designation was used randomly for some schools. To insure an "apples-to-apples" comparison, the percentage of students scoring "Advanced Plus" was added to the Advance category.